Introduction

Imagine a global marketplace where, every minute, billions of dollars change hands—not in sterile boardrooms, but in a bustling, round-the-clock arena driven by the pulse of international economies. This is the forex market, a world where currencies are traded as if they were everyday commodities, yet each transaction carries the weight of national policies, geopolitical tensions, and human sentiment. This isn’t a textbook lecture loaded with jargon; it’s a candid conversation about the true nature of forex trading, the forces that move it, and the strategies that help you navigate its turbulent waters.

The Global Landscape of Forex

At its simplest, forex trading involves buying one currency while simultaneously selling another. This process creates currency pairs, such as EUR/USD or USD/JPY, that serve as the building blocks of the market. Unlike stock exchanges that open and close at set times, the forex market operates 24 hours a day, five days a week. It’s a continuous dance where trading centers in London, New York, Tokyo, and Sydney overlap, ensuring that no matter where you are in the world, the market is always alive.

This nonstop activity isn’t just for show. The constant flow of transactions ensures that forex is the most liquid financial market in existence. Liquidity, in plain terms, means that you can buy or sell currencies almost instantly without significantly affecting the price. However, this high liquidity also brings its own set of challenges: rapid price movements can catch even experienced traders off guard, making the market as unforgiving as it is dynamic.

What Drives the Forex Market?

Forex is a unique beast, shaped by a myriad of factors that intertwine economics, politics, and even human psychology. Here are some of the major driver.

Economic data such as GDP growth, employment figures, inflation rates, and consumer spending play a crucial role in shaping currency values. For instance, a country reporting robust economic growth often sees its currency strengthen because investors are more confident in its prospects. Conversely, weak economic data can lead to a depreciation of the currency. These indicators are released on a regular schedule, and traders spend hours poring over numbers, trying to anticipate the market’s reac

Central banks are the conductors of the forex orchestra. Their decisions—whether to raise or lower interest rates, engage in quantitative easing, or tighten monetary policy—can send shockwaves through the market. A hike in interest rates, for example, generally makes a currency more attractive to investors, driving its value higher. These policy moves are often accompanied by speeches and press conferences that add layers of speculation and sometimes confusio

Political stability and international relations have a profound impact on currency values. Elections, trade negotiations, or even unexpected political upheavals can lead to significant market swings. A stable political environment tends to attract investment and bolster a currency’s strength, while uncertainty or turmoil often has the opposite effect. In today’s interconnected world, a crisis in one country can ripple across the globe, influencing forex markets far beyond its borders.

Perhaps the most unpredictable element in forex is human emotion. Market sentiment, fueled by news headlines, rumors, and the ever-present chatter on social media, can drive currencies to move in ways that defy pure economic logic. When traders collectively believe that a currency will rise or fall, their actions can create a self-fulfilling prophecy. This phenomenon makes forex a blend of hard data and human psychology—a dance where every rumor might spark a trend or a sudden sell-off.

Strategies for Trading Forex

Navigating the forex market successfully isn’t about having a crystal ball—it’s about adopting strategies that balance risk with opportunity. Here are some approaches seasoned traders use:

Fundamental Analysis

Fundamental analysis involves studying economic indicators, central bank policies, and geopolitical events to forecast currency movements. It’s akin to reading the economic pulse of a nation. For traders who prefer a long-term perspective, understanding the underlying economic factors that drive currency values is essential. This method requires staying updated on global news and having the patience to wait for market reactions to unfold.

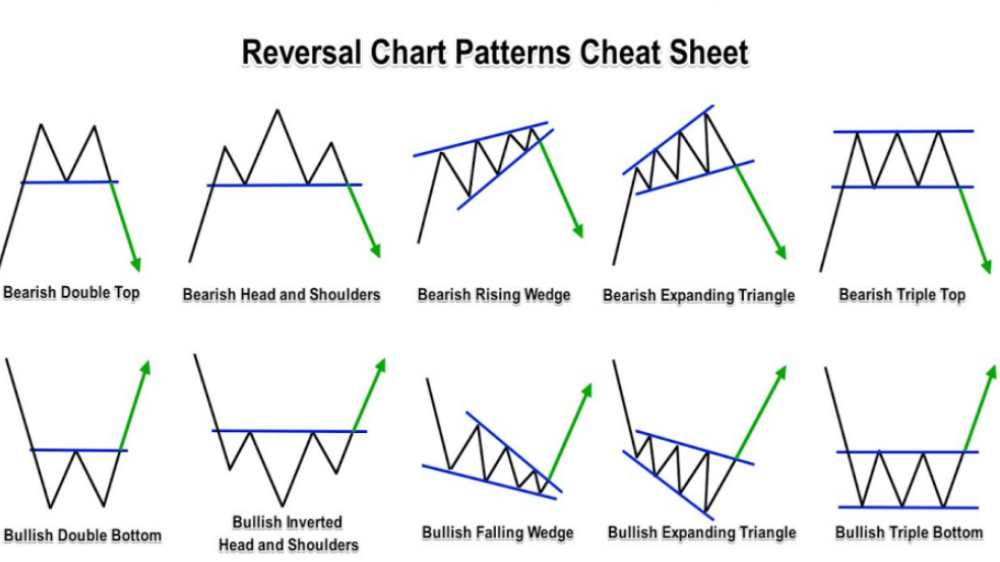

Technical Analysis

While fundamentals tell you why a currency might move, technical analysis shows you when it might move. This strategy relies on chart patterns, historical price movements, and technical indicators like moving averages and support/resistance levels. Many forex traders use technical analysis to time their entries and exits, aiming to capture short-term movements while managing risk. Unlike fundamental analysis, technical analysis is more about interpreting numbers and patterns than economic theory.

Risk Management

In forex, managing risk is just as important as spotting opportunities. Given the market’s volatility, even a small misstep can lead to significant losses. Effective risk management strategies include setting stop-loss orders, which automatically close a trade when it reaches a certain loss threshold, and position sizing, which involves carefully determining how much of your capital to risk on a single trade. The mantra here is simple: never risk more than you can afford to lose.

Diversification and Flexibility

Forex trading doesn’t have to be a one-currency game. Diversification—trading different currency pairs—can help mitigate risk. By spreading investments across various pairs, traders can cushion against the volatility of any single currency. Moreover, staying flexible and adapting strategies as market conditions change is key. The forex market is not static, and rigid strategies can quickly become obsolete in the face of new economic data or unexpected events.

The Tools of the Trade

Today’s forex traders have an arsenal of tools at their disposal. From advanced charting software to real-time news feeds, technology has transformed the way currencies are traded. Mobile trading apps allow you to monitor the market and execute trades on the go, ensuring that you never miss an opportunity—even if you’re away from your desktop. Automated trading systems, or “bots,” can execute trades based on pre-set parameters, eliminating the emotional component from decision-making.

Yet, while technology provides valuable support, it is no substitute for understanding the market’s human elements. The best tools are those that help you make informed decisions rather than replace the need for critical thinking and experience.

Real-Life Stories from the Trading Floor

Behind every forex trade, there are stories—tales of triumphs, failures, and lessons learned the hard way. Consider the trader who, after meticulously analyzing economic data, managed to predict a surprising currency rally just before a major central bank announcement. Or the story of the novice who, enticed by the promise of quick profits, ignored risk management principles and ended up learning a bitter lesson in market volatility.

These stories serve as powerful reminders that forex trading is as much about managing emotions and learning from mistakes as it is about technical prowess. Even the most successful traders can have off days, and each misstep is an opportunity to improve one’s strategy and mindset.

The Human Element in Forex

One of the most compelling aspects of forex trading is its inherently human dimension. Unlike other markets dominated by corporate earnings reports or product launches, forex reflects the collective behavior of millions of individuals and institutions. It’s where geopolitical events, economic policies, and even cultural shifts intersect with personal decisions.

The human element makes the market unpredictable, but it also makes it fascinating. It reminds us that at the heart of every trade lies not just data and algorithms, but the hopes, fears, and aspirations of people around the world. This blend of rational analysis and emotional intuition is what sets forex apart from other financial markets.

Learning the Ropes: Resources and Education

For those new to forex, the learning curve can be steep. However, numerous resources are available—from online courses and webinars to trading simulators that let you practice without risking real money. Many experienced traders also recommend joining communities or forums where you can exchange insights, discuss strategies, and even commiserate over a bad trade.

Continuous education is essential. The forex market is ever-evolving, and staying informed about new trends, emerging technologies, and regulatory changes can make a significant difference in your trading success. Think of it as a lifelong journey of learning and adaptation.

Conclusion: Embrace the Journey

The forex market is a living, breathing entity—a vast, interconnected network where global economies converge and currencies fluctuate in response to real-world events. It’s a realm where every trade tells a story, where risk and reward are two sides of the same coin, and where the human spirit of resilience and innovation shines through.

For those willing to invest the time, energy, and discipline required, forex trading offers a unique opportunity to not only profit from global trends but also to gain a deeper understanding of the world’s economic heartbeat. It’s a field where success isn’t guaranteed by any magic formula, but is earned through hard work, thoughtful strategy, and an unwavering commitment to continuous improvement.

So, whether you’re a seasoned trader or just beginning to explore the fascinating world of currency trading, remember this: forex is as unpredictable as it is rewarding. Embrace its challenges, learn from every trade, and above all, keep your eyes on the bigger picture. In the end, every experience in the forex market is a lesson in patience, strategy, and the ever-changing dynamics of our global economy.